Trying to Study at the University of Nevada, Reno While Agonizing with Financial Stress

Three students Samantha Wittke, Bethany Laslo and Adrienne Jordan share their financial ordeals while interviewing other students to find out how they cope with rising tuition, rent and groceries.

“I feel more stressed than ever before as a college student in 2025,” Samantha Wittke writes. “It's no longer just about passing my classes, and studying for exams. It’s also thinking about where I want to live next year because on campus apartments are too expensive; where can I get the cheapest groceries and gas because I don’t have the budget to spend hundreds on food; how much is tuition next year, and how can I afford to continue my education.

I am a full-time student studying journalism and psychology, as well as working a part-time job. My hours at work aren’t always consistent but I work enough to be able to afford minimal groceries. I spend about $150 a month on food. For rent I spend roughly $690 a month, which is partially covered by my parents, as well as tuition is covered by scholarships, like the Millennium and journalism scholarships.

I am currently studying journalism and psychology in hopes to enter the field of PR/advertising after I graduate in Spring 2027.

Many students are facing challenges like these when it comes to higher education. Passing classes and exams sometimes need to be put on the back burner in order to be able to provide for ourselves, and do work outside of school to grocery shop, and have a place to live.

For me, education has always been at the forefront of what I want to do to find success in my life. Going to college after high school was something I knew I was going to do before I fully even knew what that meant for me, or what I wanted to study in school.

After I graduated high school, I was the only one in my friend group who decided to go to UNR instead of Truckee Meadows Community College (TMCC) due to the cost of tuition. Yearly, TMCC costs $4,400 in tuition and fees, while in-state UNR students are paying roughly $9000 for tuition, and upwards of $30,000, if they live in the dorms and have a meal plan.

While going to university has opened many doors not going to college wouldn’t have, it comes with a cost — rising prices across everything that is attached with going to school, and it is something I think about almost as much as I think about my studies themselves.

And I am not the only one feeling this way.

Callie, who only gave her first name, is having to balance school, applying for jobs, and outside of school responsibilities as a second year student majoring in theatre tech with a scenic design emphasis. Her family lives in Las Vegas, and she lives in Reno almost full time.

She currently doesn’t have a job but has applied to an array of places just to hear nothing back, or have a hopeful interview that doesn’t go anywhere. “I’ve applied to so many jobs and I’ve had a couple interviews and sent so many follow up emails… but I am still looking,” she said.

Another big concern for Callie is housing. She currently lives in a student housing apartment near campus, but rent is going up, from roughly $650 to upwards of $800, so if she were to renew her lease for the next school year, the price is just out of range now for her to afford. She is looking into moving but is having trouble as everywhere in and around campus is overly expensive, and higher than her budget of $700 a month.

Her apartment right now is costly, roughly $650 a month, but she was hopeful when moving in this past August that it would be worth the price, but now as an almost four month resident she is starting to think that the quality of the apartment is not worth the cost at all. Cleanliness inside and outside her apartment complex is a problem, elevators are always filthy, and the outside entrance needs a much needed wash after almost every weekend.

Tuition prices are also rising as the years go on, but luckily for Callie she is on the Pack Promise+ scholarship, which allows her to go to school outside of her hometown. On the off chance that scholarship is taken away, due to changing policies within the Department of Education, she says she would have no other option but to go home

Grocery prices are also rising, and budgeting is what Callie does to stay within her means. “I try to spend under $80 every time I go to the grocery store and I look for bargains and store brand items to get the best price for everything,” she said.

UNR provides opportunities for students to get groceries through Pack Provisions, a food pantry for students on campus at the Joe Crowley Student Union. Atlas Simpson, is the Student Director at the pantry. With the rise in grocery costs the pantry has noticed more frequent visitors.

Atlas Simpson is Student Director of Pack Provisions at UNR, in the Joe Crowley Student Union. We talked about the influx of students and faculty who are visiting the food pantry, and what they have to offer through their Wolfpack Meats and Desert Farming Initiative partnerships.

“We definitely get quite a few students, we on average have…two and a half thousand visits over the course of a month. So… we usually see anywhere from 300 to 500 individual users, so each of those users are visiting multiple times,” she said.

Cost of groceries is something many students are concerned about, and a common comment heard in the pantry. “It’s something that everyone’s thinking about, especially with how expensive school is and how expensive it’s starting to get, and then with this month, having the snap cuts, we definitely saw a small increase of students who needed a little extra help,” Simpson said.

Callie and I are two of many students feeling the pressure of rising costs of almost all essentials we need to get by. Pack Provisions is a great option for students struggling to supply for themselves. But it is important to recognize that students are never facing something alone, and there is always somebody going through the same thing.

For many students like Callie, rent is the single cost that determines everything else — how much they work, what they can afford, and how much time or energy they have left for school. For students in Reno, housing is often the breaking point.”

Adrienne Jordan: “As someone who once lived in student apartments, I can attest to that. I used to pay $960 a month to live in a four bedroom apartment, which was exhausting for me to afford. I worked at a job I hated just to barely have enough money to get through each month. Thankfully I am originally from Reno, because this year I was forced to move back home with my parents, and little sister due to the cost. It doesn’t seem right to charge students these absurd amounts, who are trying to educate themselves and make their way into the real world.

One student I interviewed, who I will refer to as “B” wanted to remain anonymous, pays $750 a month for a small room in a house with three other roommates. Even with shared housing, the cost feels steep.

“It’s a pretty good location,” she said, “but it is kinda a lot of money, and I have a smaller room than the rest of my roommates.”

To be able to afford the cost of living here, B works around 30 hours a week, usually during the day. Her schedule is demanding enough that it directly affects her ability to complete schoolwork.

“When I get home I don’t really feel like doing homework,” she said. “It’s definitely taken a toll on it a little bit.” Her grades have suffered in previous semesters, but this semester she has been able to get them to all As and Bs.

She also says she can’t afford the small things she used to enjoy. Eating out is no longer an option, and most non-essential spending has disappeared from her budget entirely.

“I feel like rent definitely comes priority before everything else, which kinda sucks because it’s the biggest spending wise. But I just have to make sacrifices,” she said.

Even more frustrating is the condition of her housing. “For what I’m paying… my landlord does not fix anything on time,” she said. “It’s always like, what’s the point of me paying rent if I’m not living in livable conditions?”

She says she is unable to use heating right now, and has several leaks in her house. Alongside those, she now has mice in the walls, because of multiple holes in her roof.

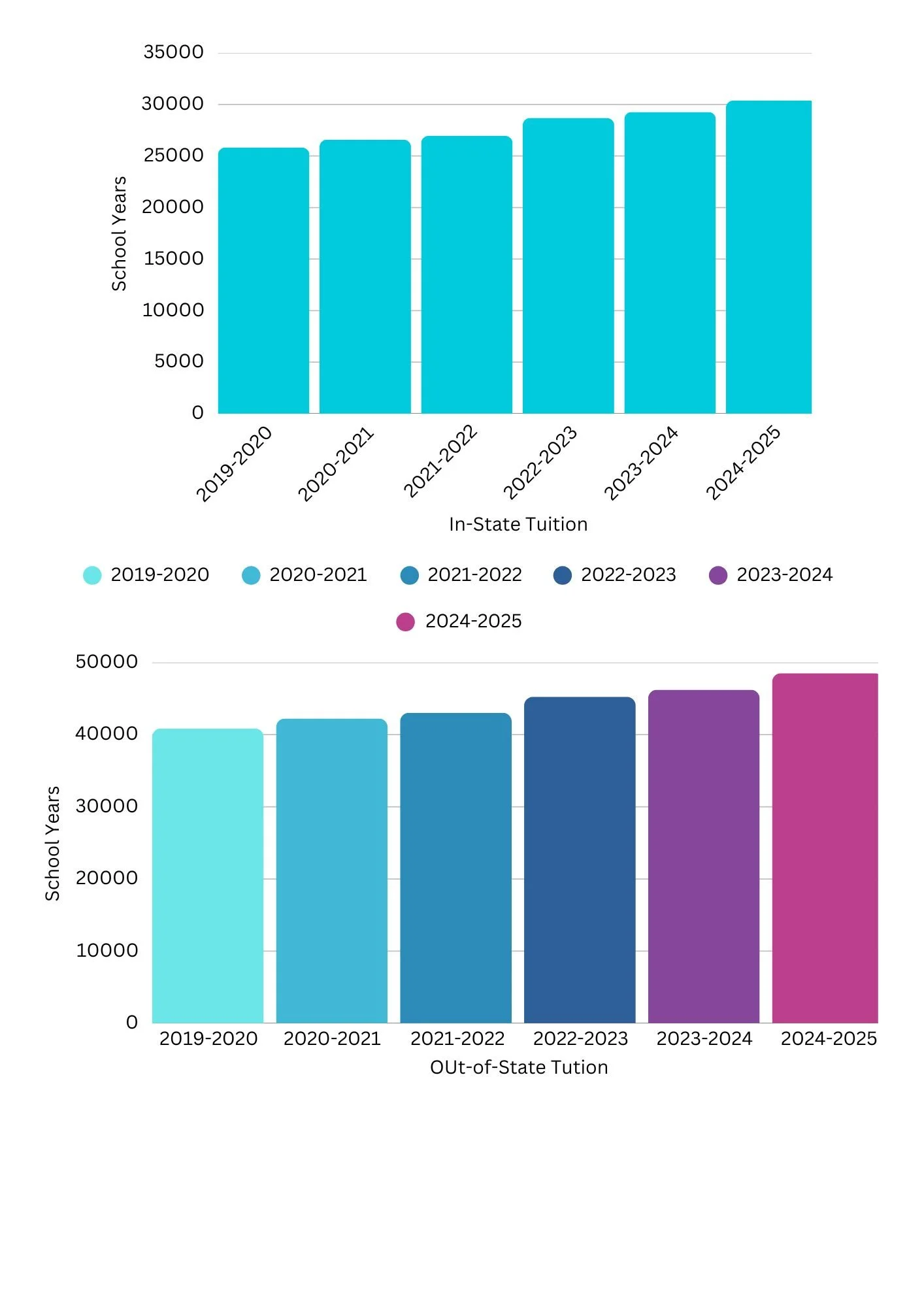

The steady rise in tuition has been a factor in student challenges.

When asked whether student housing is affordable, she paused before answering. “I feel like in certain places it can be,” she said. “But most of the time it’s overly priced for what you’re actually getting.”

Another student I interviewed, who I will refer to as “M”, also asked to stay anonymous, and faces many of the same challenges but with even higher costs. M pays around $950 a month to live in a three bedroom apartment at the Highlands, one of several large student-living apartments near campus.

“I would say it is worth it,” she said, “but apartments charge over 1000 a month just to live there. Most students don’t pay rent themselves, so it feels even harder to pay when you know all the work that went into being able to afford it.”

Even with this level of work, and the price tag to live there, the living conditions do not match what she pays. “I found mold, bugs, and other issues,” she explained. “It’s just not worth a thousand dollars a month. It should be better.”

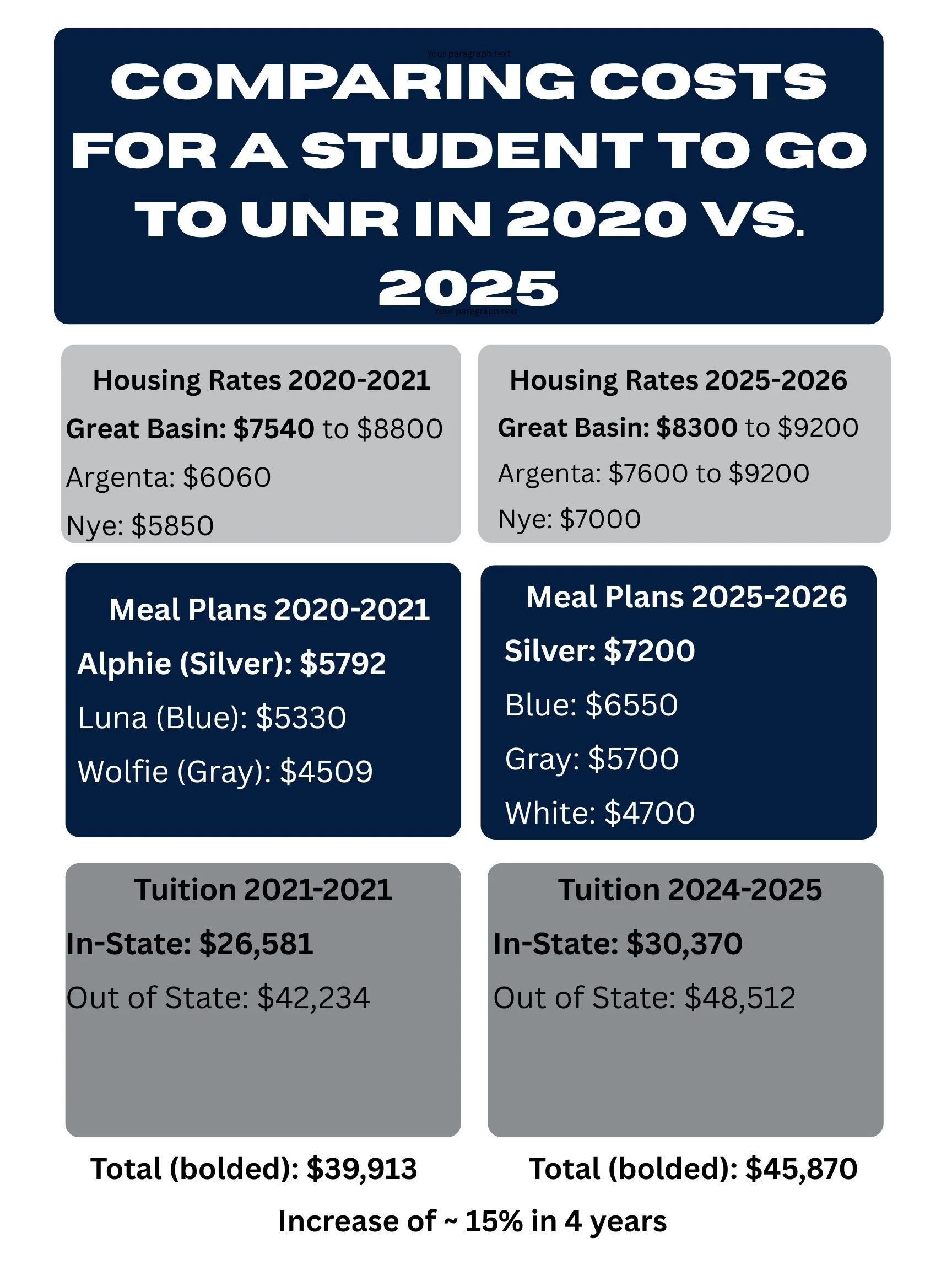

Over the past four years, students' costs for housing, meal plans, and tuition at UNR have gone up about 15-percent.

M works 30 hours a week across two different jobs. The workload leaves her with little flexibility, especially when her shifts conflict with her classes.

“Sometimes I get scheduled at work the same time as my classes,” she said. “I can’t call out, even if I want to go to class.”

The exhaustion follows her home. “Some days I’m too tired to do my homework after work,” she said.

The financial pressure has forced her to not be able to make payments on time for things she actually cared about, like her sorority dues. “I pay them late sometimes,” she said. “I’ve even had to wait to pay for gas until my paycheck came in.”

She was then left with no choice but to drop out of her sorority recently due to financial troubles, which has affected her mental health and social life.

Both M and B expressed frustration about the lack of meaningful financial support for students who pay their own way.

“If UNR did offer more support, I feel like I would know about it,” B said. B majors in history here at UNR, while M studies business. M shared the same feeling, but with more annoyance, wanting more support and resources from our university. “I’ve always gotten denied financial support from FAFSA,” she said. “I don’t get help from my parents. They need to find more ways to support students like me.”

The combination of high rent, long work hours, and limited support has pushed both students to consider leaving school altogether.

“Yeah, 100 percent,” B said when asked if she ever thought about dropping out. “It’s definitely been a thought,” M added. “Everything is just so expensive.”

Both students also shared that they’ve had to choose between groceries, rent, and school. Rent always comes first. “Rent definitely comes priority,” B said. “I have to budget my grocery costs,” M added.

B has had to stop eating out completely, and tries to eat the cheapest she can. She used to love grabbing food from TacoBell or Jimmy John’s, but hasn’t had either in a while. M has stopped spending money on ‘fun’, and has been saving money wherever she can.

Talking with B and M made it clear just how easily financial pressure shapes a student’s entire college experience. Even though I don’t live in student housing anymore due to these stresses, the issue still feels personal. These challenges affect whether students attend class, how well they perform academically, and whether they’re able to stay enrolled in school at all. It changes the whole college experience.””

Beth: “I am a full-time journalism student and part-time worker outside of UNR, also trying to get by in a stressful time and environment.

Attending university was a big decision financially. I knew for a while I wanted to go to college, I’ve always loved school. When I first got accepted, I wasn’t worried too much about the money. I hadn’t thought of how costly it would be. My mom works at UNR, so we got a discount on the tuition.

After my mom’s employee discount, my tuition comes out to about $1800 per semester, and my Millennium scholarship covers the rest. I thought I was set, my tuition was covered and that’s all college needs, right? But that didn’t include parking, books, rent, gas, or anything else. So, I decided to stay living at home, get a parking pass and a steady part-time job.

I commute to UNR every day. I leave an hour before my class starts, it takes me about 15-20 minutes to drive there, then I have to walk another 10 minutes from the west stadium parking garage to the middle of campus, and sometimes I’m late to class because of how much traffic there is on McCarran.

To be able to live stress free is a luxury for college students, one they don’t get to see often. As the school years progress, everything gets harder. And students have to pay for many things on top of tuition, many things that take a big toll on their finances, as well as their mental health.

Like M and B, Jordan Levan also had thoughts of dropping out because it was too much of a strain on her financially. Levan started UNR as a pre-nursing major. After realizing that wasn’t for her she switched to Art. A year and a half later it was all too much, she didn’t feel like she was getting her money’s worth. So, she dropped out.

In Levan’s free time when she’s not working at U-Haul, she likes to crochet, draw, paint, write, and craft. She hopes to one day open her own shop online and sell her creations.

“I stopped going to my classes, they didn’t interest me as much as they used to and then also I was just spending money for me not going to classes. So I was like, what’s the point in spending all of this money just for me to not go?” said Levan.

Students can feel regret when they drop out, what if they could have toughed it out? Levan thought of this, and it still wasn’t enough for her to stay.

“Sometimes I do regret dropping out, because I miss the routine of college. I did enjoy going to classes when I did go to them, and it just felt, I don't know, it made me feel better about like, getting up, going to class, and then going to work… I don’t regret it a lot because when I don’t have to shuffle work and school at the same time, I don’t have to spend money on school so, I don’t regret that part of it, but I do miss the activities,” said Levan.

Levan has thought of going back to school, cosmetology school that is.

“I have thought about going back, but not to college, more likely to like a cosmetology school, ‘cause I want to be, like, a hairdresser or like a nail artist,” said Levan.

Progressive politicians such as Bernie Sanders and Pramila Jayapal have proposed the ‘College For All Act’ which would allow free college and keep students debt-free. When this was brought up, Levan was all over it.

“I completely agree with that. It would help not just me, but a lot of college students, especially those who have to take out loans and then get into a lot of debt and then have to pay that on basically for the rest of their lives. So, I feel like that would really help a lot of people,” said Levan.

Liv Anderson, a senior at UNR majoring in psychology, has moved around a bit during her years. From living with her cousin and paying rent, to living at home rent free, to moving out on her own paying more rent than before, and on top of that also paying for tuition, gas and parking.

“The first two years when I was living at home, obviously my financial situation was a lot better because I wasn't paying rent to my parents, but I still had to buy my parking pass. But I wasn’t paying $1000 in rent every month,” said Anderson.

Anderson immediately nodded her head yes when asked if any of her cost of living had gone up.

“Yeah, it’s definitely gone up. My first semester freshman year, I moved out and I was paying $500 in rent, and it was really good,” she explained. “But it was because I lived with my cousin and her mom owned the condo, and so she gave us a little discount. And then my cousin ended up moving in with her boyfriend, so I moved back home. And then I decided to move out my junior year, so I moved out my junior year, and I had to get a second job. So, finances were worse because I was having to pay rent and I had less free time, and I felt like I didn’t really have much time to do anything because I had to get another job.”

A month ago Anderson quit her job. She has been having to take out of her savings account to get by, and she can’t enjoy her free time too much as it stresses her out not having a job.

“So for the past month, it has not been hard at all, work and school, because I haven’t had a job, but it’s been hard because, me not having a job is like, actually driving me insane,” she said. “Christmas is coming up, it’s a holiday so I’m stressing over having made gifts for people, and then just being able to like, not eat out as much, not go out to more places as much, not having a job.”

When it comes to choosing where to live, it always comes down to finances. Distance and area determine how much will be spent on gas, if a parking pass is needed, as well as how much rent will be.

“When I was commuting, and it was like 30, 35 minutes there and … 30, 45 minutes back because I would be driving home in traffic… I was getting gas every week and it was probably like $70 every week I was spending on gas, just to go to work and go to class,” said Anderson.

The entire point of going to college is to build a future where you can be financially stable, yet for many of us, it feels almost impossible to focus on school while trying to survive day-to-day.

For the three of us reporting on this project, we all feel the pressure to do as best as we can to make ends meet and be good people and good students. Sometimes that means having to prioritize work over school, or stressing over finances, places to live, and more. But at the end of the day we are doing what we can, and we still feel pursuing degrees in higher education is worth that battle. Hopefully, it will be worth it.

Feel free to share this story on the below social media: